Verde Valley Real Estate 2023 in Review

The 2023 housing market witnessed a significant shift, marking the end of an 11-year trend of rising single-family home prices. This shift reflects the interaction of economic factors, primarily influenced by changes in mortgage interest rates and their impact on both buyers and sellers.

Key Factors Influencing the 2023 Housing Market:

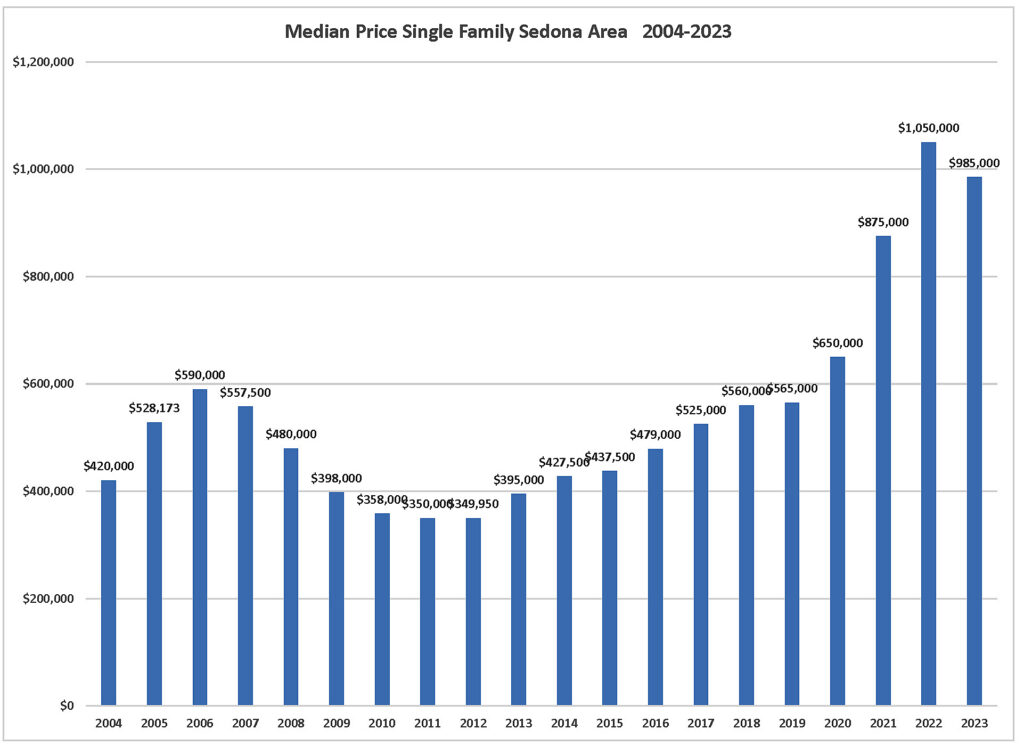

Decline in Median Sales Price: The median sales price of a single-family home in the Sedona market, which had seen a steady increase over 11 years, peaked in 2022 at $1,050,000. 2023 experienced a 6% decline, dropping to $985,000. This reversal in price trend was noteworthy, as it marked the first drop in over a decade.

Rapid Price Increase Over the Decade: The journey to the peak price in 2022 was marked by a substantial 300% increase from $349,950 over 11 years. Notably, a significant portion of this increase, amounting to $485,000, occurred during the three years of the COVID-19 pandemic, reflecting the unique market dynamics.

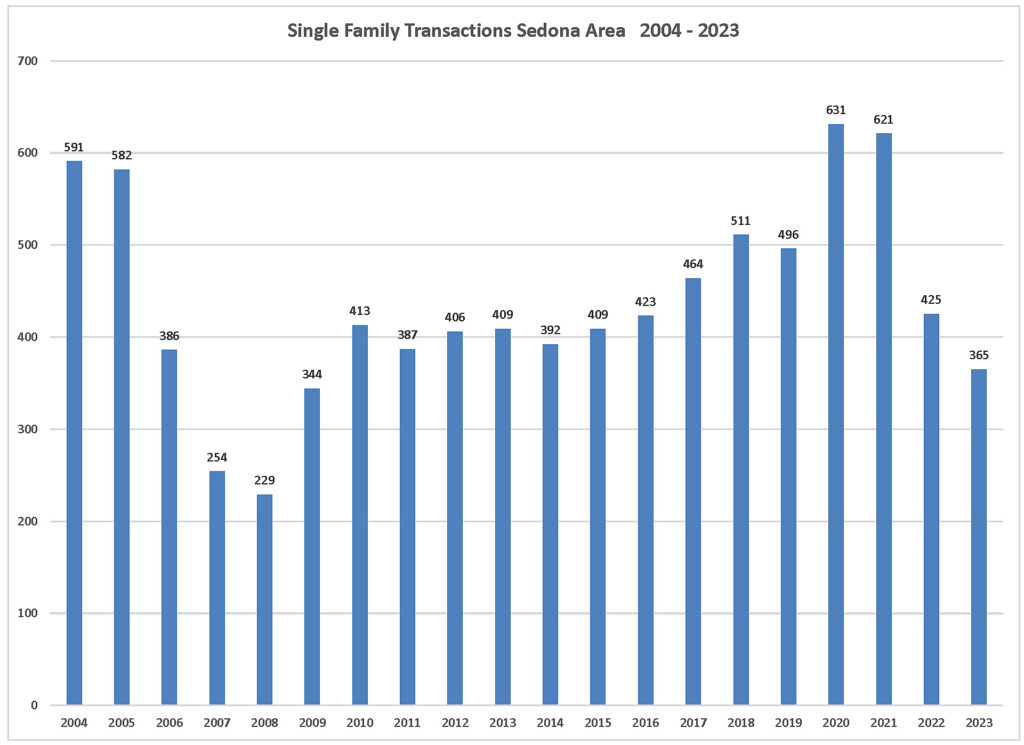

Sharp Drop in Sales Volume: One of the most striking aspects of the 2023 market was the steep 42% decrease in sales over three years, from a peak of 631 sales in 2020 to just 365 in 2023. This reduction in sales volume played a crucial role in influencing median prices.

Impact of Rising Interest Rates: The primary driver behind these market changes has been the dramatic rise in interest rates. With rates nearing 8% in October 2023, there was a marked cooling effect on buyer enthusiasm. The high rates made new mortgages significantly more expensive than in previous years, directly impacting buyers’ affordability.

Mortgage Rate Lock-In Effect: Approximately 85% of existing mortgages were locked in at rates below 5%, a figure significantly lower than the prevailing rates in 2023. This disparity created a disincentive for potential sellers, who were reluctant to trade their low-rate mortgages for the higher current rates. The result was a decrease in the number of homes being put up for sale.

Increase in Residential Inventory: Despite homeowners’ reduced sales and reluctance to sell, there was a 67% increase in residential inventory in the Sedona area and a 33% increase in the Verde Valley over the year. The most significant spike in inventory was observed in the last quarter of 2023, aligning with when sales slowed considerably.

Interest Rates in 2024: There is a flicker of hope for potential homebuyers, as mortgage rates, which reached a recent high of nearly 8%, are expected to fall. The National Association of Realtors (NAR) and realtor.com forecast a decline in the 30-year fixed-rate mortgage. NAR predicts an average rate of 6.3%, while realtor.com projects a slightly higher average of 6.5%.

The predicted fall in mortgage rates is expected to improve housing affordability. The decline in mortgage rates will likely entice more buyers back into the market. Potential buyers previously deterred by the high cost of borrowing may find the new rates more manageable, leading to an increase in home purchasing activities.

Cumulative Days on Market: As the market adjusts to the higher mortgage rates and increased inventory, homes will likely remain on the market for longer periods. This adjustment period could extend into the foreseeable future until a new balance is reached between buyers’ affordability and sellers’ expectations.

The cumulative days on the market for 2023 were 77, which marked a 40% increase from the 51 days in 2022. The current median time on the market for active listings not under contract stands at 86 days. This figure further supports the notion that homes are taking longer to sell. For sellers, it may necessitate more competitive pricing and better property presentation to attract potential buyers within a timeframe that meets their goals.

Just the Facts: Sedona: 2023 saw the first drop in the median sales price of a single-family home in 11 years. Prices peaked in 2022 at $1,050,000 and dropped 6% in 2023 to $985,000. Over those 11 years, the median sales price increased from $349,950 to $1,050,000, a 300% increase, with $485,000 of that gain coming in the three years during COVID. Triggering the drop in the median sales price has been the significant slowdown in sales from the peak of 631 sales in 2020 to 365 sales in 2023, a 42% drop in sales over that three-year period. This precipitous drop in sales has been fueled entirely by interest rates. The climb in the interest rate to near 8% in October 2023 and the fact that 85% of existing mortgages are below 5% discourages potential sellers from putting their homes on the market. Residential inventory increased 67% over a year ago, with the most significant increase in the last quarter of 2023 as sales came to their slowest rate of the year.

Vacant land transactions for 2023 came in at 104, a 40% decrease over 2022 and a third of the sales in 2021. The median sales price for vacant land sales remained relatively strong, coming in at $262,500, down just 12.5% from 2022’s $300,000. Vacant land sales prices are being somewhat buoyed by the low amount of inventory with just 127 vacant lots for sale at the start of 2024.

Home sales over $1,000,000 continue to soar. Of the 365 single-family sales in 2023, 177, 48%, were above $1,000,000. That is a drop of 22% from the 229 sales in 2022, which is to be expected with the overall drop in sales year over year. As of this writing, there are 111 single-family homes for sale that are not under contract, with 79 of them priced at over $1,000,000 and a median asking price of $1,350,000.

Cumulative days on the market for 2023 came in at 77 days, up 40% from 51 days in 2022. This is a direct result of the 30-year mortgage rate increase and the increase in the number of homes on the market. We can expect the median cumulative days on the market to continue to rise. The current median time on the market for active listings not under contract is 86 days.

The median sales price for townhomes and condos saw the same 6% drop in median sales price as single-family homes. The median sales prices for condos and townhomes came in at $565,000, down from $600,000. The number of sales dropped 19% to 98 from 120 in 2022. The interest rate again plays a starring role in this drop in sales and prices.

The median price for mobile homes not on leased land was $463,000, down 3.5% from the record high of $479,500. The number of sales came in at 31, a 26% drop from 42 in 2022.

Camp Verde: The median sales price for single-family homes in the Camp Verde area for 2023 was $453,750, virtually unchanged from 2022’s $455,000. The number of sales continued to drop from 144 in 2021 to 84 in 2023, a 42% drop over the two years.

Lake Montezuma and Rimrock: The median sales price for single-family homes in the Rimrock and Lake Montezuma area for 2023 was $380,000, up 4% from 2022’s $365,000. This is an all-time high for this area. The number of sales came in at 52, down 36% from 81 in 2022.

Cottonwood and Cornville: The median sales price for single-family homes in the Cottonwood and Cornville area for 2022 was $457,265, up 3% over 2022. This is the highest median sales price in this area ever. The number of sales in 2023 came in at 425, down 20% from 534 in 2022. This is a 30% drop from the peak sales in 2021

The Bottom Line: The 2023 housing market dynamics illustrate the critical impact of interest rates on real estate markets. As rates climbed, the market reacted with a slowdown in sales and an increase in inventory, leading to a decrease in median home prices. This situation presented challenges for both buyers, who faced higher borrowing costs, and sellers, who were hesitant to lose their favorable mortgage rates.Looking forward, all indications are the 30-year mortgage rate will remain high for at least the first two quarters of 2024 and maybe through the third quarter. These trends will continue to shape the housing market, depending on the direction of interest rates and broader economic conditions. Buyers and sellers alike will need to navigate this altered landscape with careful consideration of their financial positions and long-term housing needs.

For the complete Sedona and Verde Valley Real Estate 2023 Review

Recent Comments