Sedona and Verde Valley Real Estate

Second Quarter 2023

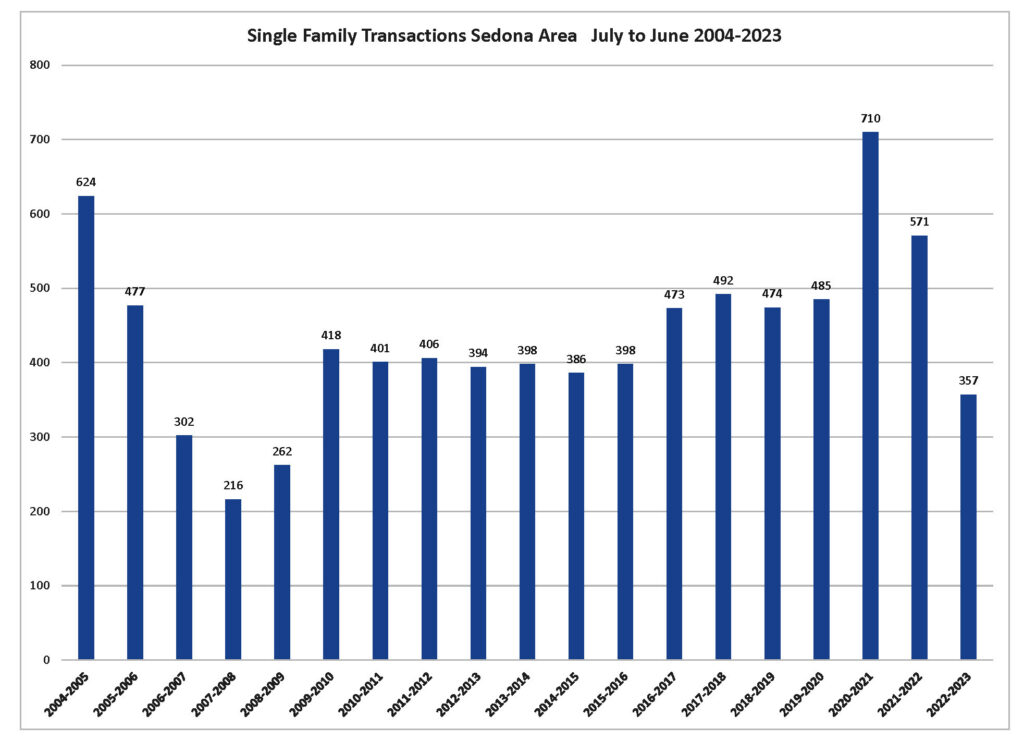

I think transition is the best word that defines the current real estate market in Sedona and the Verde Valley. The definition of transition: the process or a period of changing from one state or condition to another perfectly describes the state of our market today. Two years ago, at this time, we were at the apex of the market in terms of the number of sales. Since then, we have seen the number of sales for single-family homes in the Sedona area transition from a peak two years ago of 710 to 571 a year ago to 357 for the last 12-month period, a 50% drop in sales over two years.

Sedona Single Family homes sales 2004 to 2023

A similar decline in single-family sales occurs when you compare single-family sales for the first six months of the year. In the first six months of 2021, there were 310 sales, then 262 in the first six months of 2022, followed by 194 sales in the first six months of 2023, a 38% decline.

It is interesting to note that while this slowdown in the number of sales of single-family homes was occurring, the median sales price continued to rise. Two years ago, the median price for a single-family home in the Sedona area was $751,250. The median sales price was $975,000 a year ago, and despite the impressive reduction in sales in the last 12 months, the median sales price continued to rise to $999,000. That is a 32% increase in two years while sales plummeted 50%—quite an interesting juxtaposition.

So, we have seen the transition in the number of sales year over year but what about some of the other key indicators?

- The median sales of single-family homes in Sedona for the first six months of 2023 declined 11% to $999,000 from $1,120,000 in the first six months of 2022

- Sales over $1,000,000 were 196 two years ago, 270 a year ago, and 175 for the last 12 months, a 35% decline over the previous 12 months.

- Days on the market a year ago were 47, the last 12 months were 70, and for the first six months of 2023, they came in at 90. Effectively days on the market have doubled.

- Vacant land sales in theSedona area have declined more precipitately than single-family sales. There were 336 land sales two years ago, 218 a year ago, and just 100 in the last 12 months, a 70% drop in two years.

- Residential inventory in the Sedona area in January 2022 was at its low of around 100 units. Today it is at about 200, a 100% increase. Residential inventory is still about 40% below what would be considered a market in balance.

So what brought on the transition? Before Covid hit the planet, the Sedona market had seen prices rise for ten years. With Covid, it was as if an accelerant had been added to the market. Prices and sales skyrocketed, then inflation hit the United States and the world, the Feds put the brakes on the economy, and our real estate market was full stop. The Feds stepped in and raised the rate from 0% in March of 2020 to 5%, where it is today.

The mortgage interest rate increase came along with the Fed increase and has been a major factor in the market transition, but there is more at play.

- Over 60% of the mortgages in the United States are below 4%. This is keeping folks in their current home.

- Inventory of residential homes for sale is 50% of what is needed for a balanced market and keeps prices from falling dramatically.

- Buyers have always sought a way to help them afford our market. Over the last couple of years, buyers purchasing homes as short-term rentals have significantly impacted sales and prices.

Just the Facts:

Sedona Area, Areas 40-46:

The median price of a single-family home was $999,000 for the last 12-month period. This was a 2.5% increase over the previous 12-month period despite the significant slowdown in sales during the last 12 months. The previous 12-month period saw 357 sales of single-family homes, a 38% decrease over the last 12-month period and a 50% decrease compared to sales two years ago, which was at the market’s high point. For the first six months of 2023, there were 194 single-family sales compared to 262 in the first six months of 2022, a 25% decrease and a 38% decrease compared to the first half of 2021. The median sales price for single-family homes in the Sedona area for the first six months of 2023 came in at $999,000, down 11% from the first six months of 2022.

Combined with the slowdown in sales, we are seeing residential inventory rise, which was to be expected. Overall residential inventory is at about 200 properties which is twice as high as in January 2022.

Vacant land transactions have taken a hit. Vacant land sales for the last 12 months came in at 100 sales compared to 218 for the previous 12-month period, a 55% drop. The median sales price remained strong, coming in at $277,500. However, that was an 8% drop from the previous 12-month period.

Of the 377 single-family homes sold in the last 12 months, 175, 50%, were over $1,000,000. This is a 35% drop in the year-over-year $1,000,000 plus sales. That puts the median sales price for a single-family home in Sedona right at a million bucks!

Cumulative days on the market came in at 70 days, a 49% increase over the last 12 months. Even more of a tell for the market is the median cumulative time on the market for the first six months of 2023 came in at 90 days. The homes that are selling are taking longer to sell.

The Condominium and Townhome market showed a slight weakening with a 4% drop in the median sales price to $577,500, down from $600,000 with 100 sales for the last 12-month period.

Camp Verde Areas 20-23:

The median sales price for single-family homes in the Camp Verde area for the last 12-month period came in at $425,000, 6% lower than the previous 12-month period. The number of sales came in at 85, a 35% drop from the last 12 months. The median price for a single-family home in the Camp Verde area for the first six months of 2023 rose to $530,000, up 9% from the first six months of 2022’s $485,000. The number of sales for the first six months fell 11% to 47 sales compared to 53 for 2022.

Lake Montezuma and Rimrock Areas 30-33:

The median sales price for single-family homes in the Rimrock and Lake Montezuma area for the last 12 months came in at $351,000, a 5% drop from the previous 12-month period. The number of sales for the last 12 months came in at 69 sales, down 24% from the previous 12-month period. The median sales price for the year’s first six months came in at $367,000, down 6% from the first Six months of 2022. The sales for the first six months of 2023 came in at 32, down 28% from the first six months of 2022.

Cottonwood and Cornville Areas 10-17:

The median sales price for single-family homes in the Cottonwood and Cornville area for the last 12 months came in at $435,000, up 1% from the previous 12-month period’s $430,00. The number of sales came in at 435 compared to 628 for the previous 12-month period, a 31% drop. The median sales price for the first six months of 2023 was $430,000, down 3% from the first half of 2022. The number of sales for the first six months of 2023 came in at 219 sales, down 10% from the first six months of 2022.

The Bottom Line: Our market is in a period of transition, from fast-paced sales and rapidly increasing prices to one of declining sales and prices. Homes are taking longer to sell. Interest rates will remain high for the balance of 2023. Prices are decreasing but are buoyed by an inventory shortage, but they remain significantly higher than two years ago. Most sellers have a considerable amount of equity; it will just take a little more time on the market to realize it.

For the full Second Quarter 2023 Report

Recent Comments