Verde Valley Real Estate 2022 in Review

2022 was the year of transition. We moved from a time of almost no inventory to three times the amount of inventory, we saw interest rates more than double in just a few months, we saw sales drop off almost 50% in the last half of the year, we saw inflation move to 9%, we saw continued impacts from Covid 19, and we are living with a war in Ukraine that has had a considerable impact on world energy prices. Whew, almost too much to take in in just one year.

When we started the year Sedona inventory was at record lows, with 31 active, not under contract listings for sale, with a median asking price of $1,650,000. Over the course of the year, we saw the active listings rise to around 125 listings and then fall back to around 95 active listings, with a median asking price of $1,198,000. A 300% increase in inventory and a 27% decrease in the median asking price in just a years’ time.

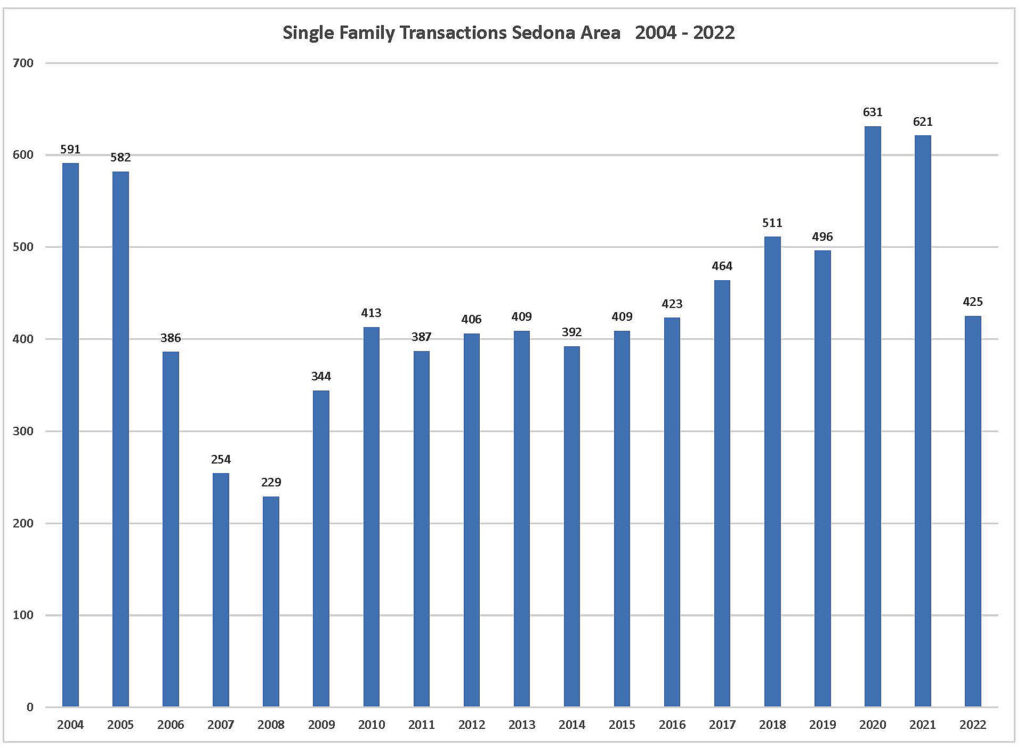

Thanks to the meteoric rise in interest rates from around 3% in January of 2022, up to 7.25% in October, the number of sales for single family homes in the Sedona area dropped 31% to 425 sales in 2022 from 621 in 2021.

As 30-year mortgage interest rates moved from 3.45% on January 1, to 4.6% on April 1, to 5.7% on July 1, to over 7% in November, we saw a momentous drop in the number of sales. This was notably reflected in the last six months of 2022. Sedona area sales for the last six months dropped to 162 sales compared to 263 sales in the first six months, a 38% decline.

We ended 2022 with the median sales price for single-family home in the Sedona area at $1,050,000 a 20% increase over 2021. During the course of the year, however, we saw an actual decrease in the median sales price when looking at the sales on a quarterly basis. The median sales price in the first quarter of 2022 was $1,150,000, $1,075,000 in the second quarter, $999,000 in the third quarter and ended the year at $980,000 in the fourth quarter. The result was a 15% decrease in the median sales price over the course of the year. Strong sales in the first two quarters of 2022 accounted for the eventual median sales price of $1,050,000 for 2022.

So here we are:

- The median sales price in 2022 for all areas of the Verde Valley are at records highs: $1,050,000 for Sedona, $455,000 for Camp Verde, $365,000 for Rimrock/Lake Montezuma, and $455,000 for the Cottonwood/Cornville area.

- The number of sales for all areas of the Verde Valley are off from their 2021 highs, down 31% in Sedona, down 37% in Camp Verde, down 15% in Rimrock/Lake Montezuma, and down 12% in the Cottonwood/Cornville

- Residential inventory increased over the course of the year as sales slowed but still remain 40% lower than in January of 2020.

- Interest rates are in the 6.5% range off their highs over 7%.

- Median cumulative days on market for active listings are at 105 days compared to 51 days for sales in the last two years.

- Of the 425 Single family sales in the Sedona area in 2022, 229 of the sales were over $1,000,000.

- Of the 425 single family sales in the Sedona area in 2022, 48% were cash sales. Of the 1131 single family sales in the Verde Valley, 37% were cash sales.

So, what is in store for 2023:

Inventory will still remain tight. We have a significant housing shortage in the Verde Valley and everywhere in the country. Sellers, especially baby boomers, are reluctant to place their homes on the market. For the most part many have significant amounts of equity and if they have a mortgage, it is at 3 or 4 percent. If they sell and need a new loan it will be at today’s 6.5%. When they do the calculations, they are good to stay in place.

Interest rates are expected to remain high for most of 2023, in the 6.5% range. The Fed is determined to raise interest rates and not lower them until they are certain that the inflation rate has slowed into at least the 3 or 4 percent range, they would like 2 or 3. If the Feds say they are pausing their rate increases or actually lower them, we will may see rates decline in the last quarter of the year.

We can expect to see homes sales continue at the pace we have seen over the last six months of 2022 as long as interest rate remain high. The pace of sales in the last six months puts us closer to the level of sales we had prior to the Covid 19 pandemic.

The California real estate market, which feeds us many of our buyers is expected to slow by around 8%, with an expected 9% decrease in their median sales price. This will translate into fewer buyers for our market with less money to spend on a new home.

Just the Facts:

Sedona area: Even in light of the 31% drop in the year over year number of sales, the median sales price for single family homes in the Sedona area rose to a new high of $1,050,000, a 20% increase in 2022 from 2021. What I feel is the most significant statistics, is the median sales price for a single-family home rising 60% in just the three-year period from 2020. As I mentioned above, the number of sales dropped 31% in 2022 to 425 sales from 621 sales in 2021. There were 162 sales in the last half of 2022 compared to 309 sales in the last half of 2021, a 48% drop in the number of sales in the last half of 2022. I feel this is solely contributed to the doubling of the 30-year mortgage rate. Residential inventory has increased 67% over a year ago but still remains historically low and will provide some buoyancy in supporting prices from dropping significantly. Overall, we still have a housing shortage in the Verde Valley and most of the country.

Vacant land transactions for 2022 came in at 172, a 46% decrease over 2021. This number of sales fell back in line with the range of sales over the last several years. In spite of the drop in the year over year number of sales, the median sales price rose to $300,000 a 20% increase over the $250,000 median sales price for 2021. Vacant land lot inventory is down 20% from January of 2022 to 125 listings and has been bouncing around this level for the last year. This is at historic lows for lot inventory. Land in the Sedona area is a limited resource, eventually it will all become developed.

The luxury market, home sales over $1,000,000, continues to soar. With the median sales price for 2022 at $1,050,000, it is self-explanatory that over 50% of the homes sales were over $1000,000, and indeed it was. 229 of the 421 sales over $1,000,000, 54% of the total sales. As of this writing there are 95 active single-family homes for sale and of those, 58 are priced over $1,000,000. Median asking price for the active listings is $1,198,000.

Cumulative days on the market for 2022 came in at 51 days, exactly the same as in 2021, strange but true. We can expect the median cumulative days on market to take a pretty good jump in 2023. At this writing the median cumulative days on market for the active listings is 105 days. We currently have 300% more active listings, not under contract, than we had in January of 2022.

With the overall shortage of residential inventory and the high price of single-family homes, the median sales price for condos and townhomes jumped to $600,000, up 20% over 2021’s $498,000. The number of transactions for the last 12-month period was 120, down 13% from 2021.

The median price for mobile homes came in at $479,500, a new record high, up 20% from $399,000 in 2021. Sales were up 13% to 42 sales from 37 in 2021.

Camp Verde:

The median sales price for single family homes in the Camp Verde area for 2022 was $455,000 up 9% from 2021. Its highest yearly total ever. The number of sales for 2022 came in at 91 sales down 37% from the record high of 114 sales in 2021.

Lake Montezuma and Rimrock:

The median sales price for single family homes in the Rimrock and Lake Montezuma area for 2022 was $365,000 up 10% from 2021’s $331,500. This too is an all-time high for this area. The number of sales came in at 81 sales down 15% from 96 sales in 2021.

Cottonwood and Cornville:

The median sales price for single family homes in the Cottonwood and Cornville area for 2021 was $455,000 up 15% over 2021. This is the highest median sales price in this area ever. The number of sales in 2022 came in at 534 sales down 12% from 603 sales in 2021.

The Bottom Line: All indications are the 30-year mortgage rate will remain high for at least the first two quarters of the year and maybe through the third quarter, we will hope not any longer. We will see more homes on the market and an increase in the inventory. A good portion of the increase will be due to the slower pace of sales. Buyers will contend with high prices, high interest rates and lower buying power. We can expect to see prices decline and sales will be at a slower pace than we saw in 2020 and 2021, closer to pre-pandemic levels. No matter what, nothing is static, everything changes. Folks will come and go from the Verde Valley as they have always done.

Recent Comments