Sedona and Verde Valley Real Estate

First Quarter 2023

The first quarter of 2022 marked the high-water mark for the upward-trending real estate market that Sedona had been experiencing for the previous 11 years. There was an acute shortage of inventory that had been contracting for eight years, which was intensified by the unanticipated increase in the number of sales during the pandemic, wholly facilitated by historic low-interest rates.

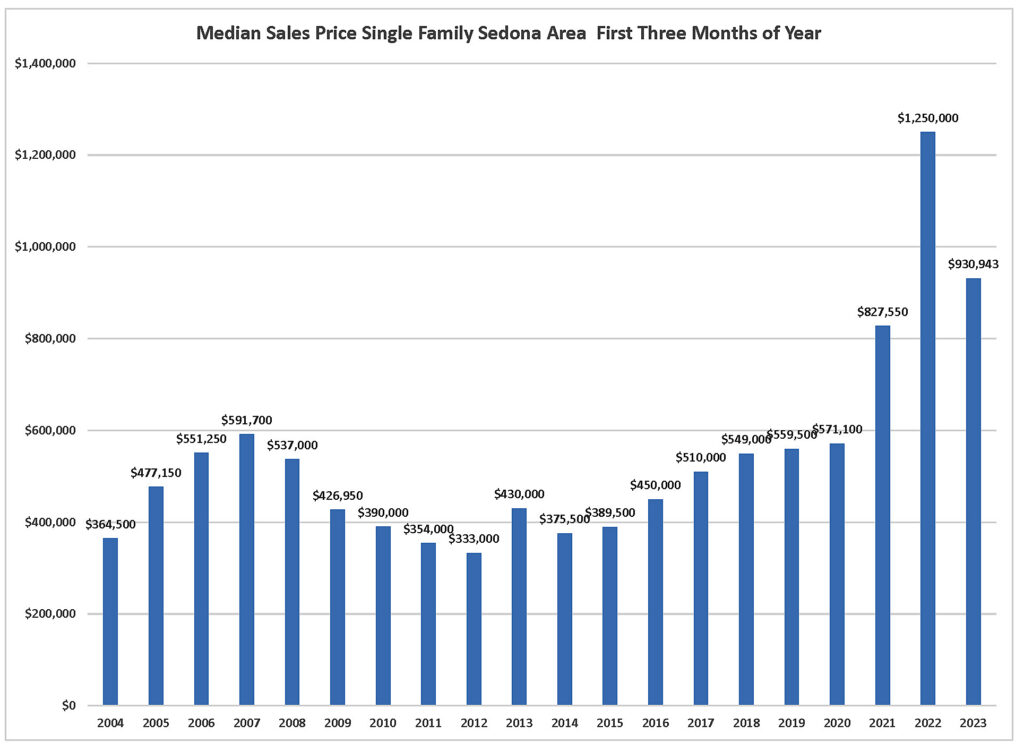

Median Sales price for a Single Family in Sedona AZ Q1 2023

If you were to look at the median sales price of a single-family home in the Sedona market for the last 12 months, you would see that it rose 8% to $990,000 compared to the previous 12 months’ $916,000. But honestly, this does not tell the underlying story.

Beginning in March 2022, the 30-year mortgage interest rate rose from just over 3% at the beginning of 2022, peaking last November at over 7% and settling back into the 6.5% range today. Today’s interest rates have significantly impacted the market with reduced affordability. Combine the meteoric price rise with a doubling of the interest rate, and fewer folks can afford to buy a home.

Reduced affordability has impacted housing markets most significantly on the West Coast, where prices have risen the highest over the last three years. The West Coast is where many of our buyers come from, resulting in a striking drop in sales over the previous 12 months.

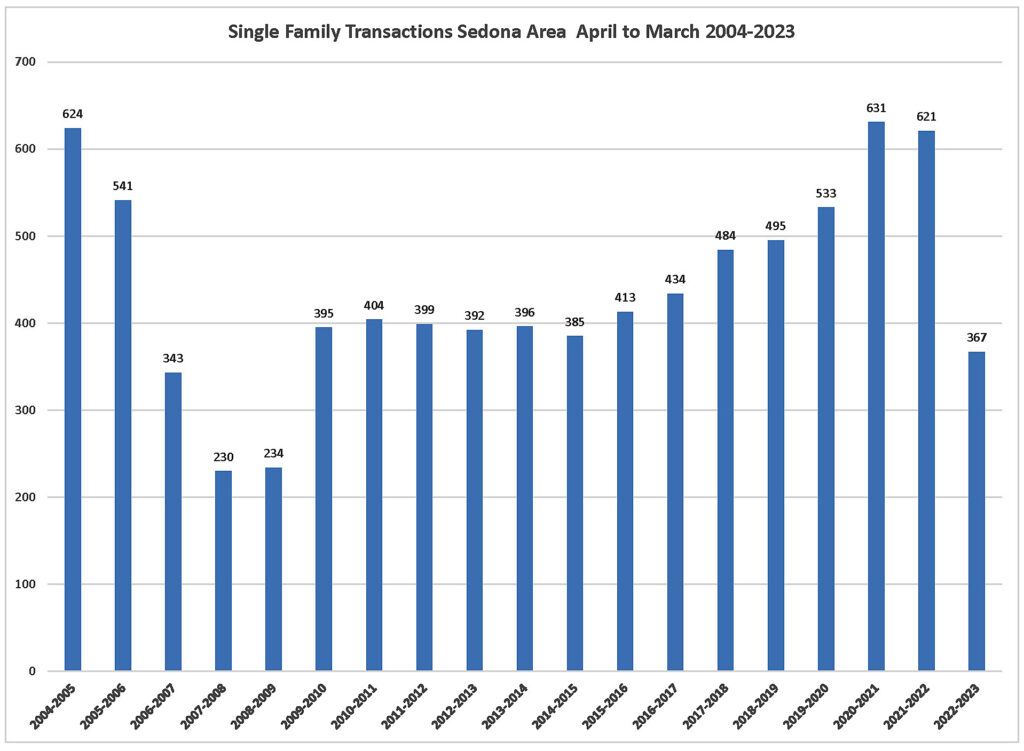

Sedona AZ Single Family sale 2004 to 2023

Even with the slowdown in sales, the Sedona market is still experiencing an inventory shortage. We have about half of the homes on the market today compared to January 2020, before the pandemic started. Many homeowners will stay put and weather the storm in the housing market. Plenty are locked into mortgages with very low rates. That will make them think twice before selling their property and purchasing a new one with a mortgage rate that will be significantly higher. Even if they’re downsizing into a much smaller home, it could cost them significantly more to do so. This has been especially true for Baby Boomers who have been staying healthier, living longer, and opting to remain in their homes longer before selling.

Interest rates are expected to remain high thanks to the Federal Reserve. Mortgage rates followed a similar upward trajectory as the Fed hiked its interest rate to slow inflation. And the Fed seems committed to continued high rates. I expect mortgage rates to remain at higher levels for most if not all of this year.

Just the Facts:

Sedona Area, Areas 40-46:

The median price of a single-family home was $990,000 for the last 12-month period. This was an 8% increase over the previous 12-month period despite the significant slowdown in sales during the last 12 months. This increase in median sales price can be attributed to the strong sales in the second quarter of 2022 before the slowdown occurred due to rising interest rates. The last 12-month period saw 367 sales of single-family homes, a 41% decrease over the previous 12-month period. This was the lowest number of sales over this period in the last 13 years. For the first three months of 2023, compared to 2022, there were 73 single-family sales compared to 105 in the first three months of 2022, a 31% decrease and a 43% decrease compared to the first quarter of 2021. The median sales price for single-family homes in the Sedona area for the first three months of 2023 came in at $930,940, down 25% from the first three months of 2022. This 25% drop represents two things; first, the first quarter of 2022 was the high-water mark for the market impacted by critically low single-family inventory, and second, the actual impacts of rising interest rates being felt in the market.

Combined with the slowdown in sales, we are seeing residential inventory rise, which was to be expected. At the beginning of April 2022, there were 26 single-family homes not under contract., As of today, there are 86 single-family homes for sale not under contract, a 300% increase over a year ago. What is unusual about this current market is that despite this increase in inventory over the last year, we still need more. Today we have about half the inventory we had before the pandemic started in January 2021.

Vacant land transactions in the last 12-month period dropped off the proverbial cliff. Vacant land sales for the last 12 months came in at 125 sales compared to 293 for the previous 12-month period, a 58% drop. The median sales price remained strong, coming in at $315,000, up 14% from the last 12-month period.

Of the 367 single-family homes sold in the last 12 months, 181, 51%, were over $1,000,000. This is a 31% drop in the year-over-year $1,000,000 plus sales. With the Sedona area median sales price above $900,000, this market segment will remain strong in the coming years.

Cumulative days on the market came in at 59 days, a 22% increase over the last 12 months. A more significant number and a better reflection of the current market is the cumulative days on the market for single-family sales. The first quarter of 2023 came in at 120 days, double the days on the market for the last 12 months.

The Condominium and Townhome market remained strong with the median sales price coming in at $622,570, with 100 sales in the last 12-month period.

Camp Verde Areas 20-23:

The median sales price for single-family homes in the Camp Verde area for the last 12-month period rose to $470,000, 9% higher than the previous 12-month period. The number of sales came in at 89, a 32% drop from the previous 12 months. The median price for a single-family home in the Camp Verde area for the first three months of 2023 dropped to $472,500, down 11% from the first three months of 2022’s $528,650. The number of sales for the first three months fell 8% to 22 sales compared to 24 for 2022.

Lake Montezuma and Rimrock Areas 30-33:

The median sales price for single-family homes in the Rimrock and Lake Montezuma area for the last 12 months came in at $361,295, a 1% drop from the previous 12-month period. The number of sales for the last 12 months came in at 74 sales, down 24% from the previous 12-month period. The median sales price for the year’s first three months came in at $371,500, down 5% from the first three months of 2022. The sales for the first three months of 2023 came in at 12, down 37% from the first three months of 2022.

Cottonwood and Cornville Areas 10-17:

The median sales price for single-family homes in the Cottonwood and Cornville area for the last 12 months came in at $440,500, up 8% from the previous 12-month period’s $407,950. The number of sales came in at 496 compared to 624 for the previous 12-month period, a 21% drop. The median sales price for the first three months of 2023 came in at $425,000, down 2% from the first quarter of 2022. The number of sales for the first three months of 2023 came in at 94 sales, down 30% from the first three months of 2022.

The Bottom Line: Inventory will stay in short supply as folks remain longer in their homes with a low-rate mortgage. High mortgage rates will continue to impact the affordability of homes, especially in the Sedona market, where prices are the most elevated. High prices and high-interest rates will help to keep a lid on the number of sales. On the positive side, if you are thinking of becoming a seller in this market, you can still realize most of the significant gains accrued to the market over the last several years. With lower inventory, there will be less competition.

For the full First Quarter 2023 Report

Recent Comments