Sedona and Verde Valley Real Estate 2021 in Review

Exceptional, outstanding, extraordinary, phenomenal, unequalled, unparalleled, unrivalled, unsurpassed, unexcelled, peerless, matchless, second to none all qualify to describe the 2021 real estate market in Sedona, the Verde Valley and the nation as a whole. Every segment and every area of our market produced numbers that we have not seen before. From the total numbers of sales, to median sales prices, to time on market, sales over $1,000,000, to the lack of inventory. Like no other market that we have ever experienced. If you were a seller during this time, you were giddy with anticipation, if you were a buyer, frustration and anxiety plagued your every offer.

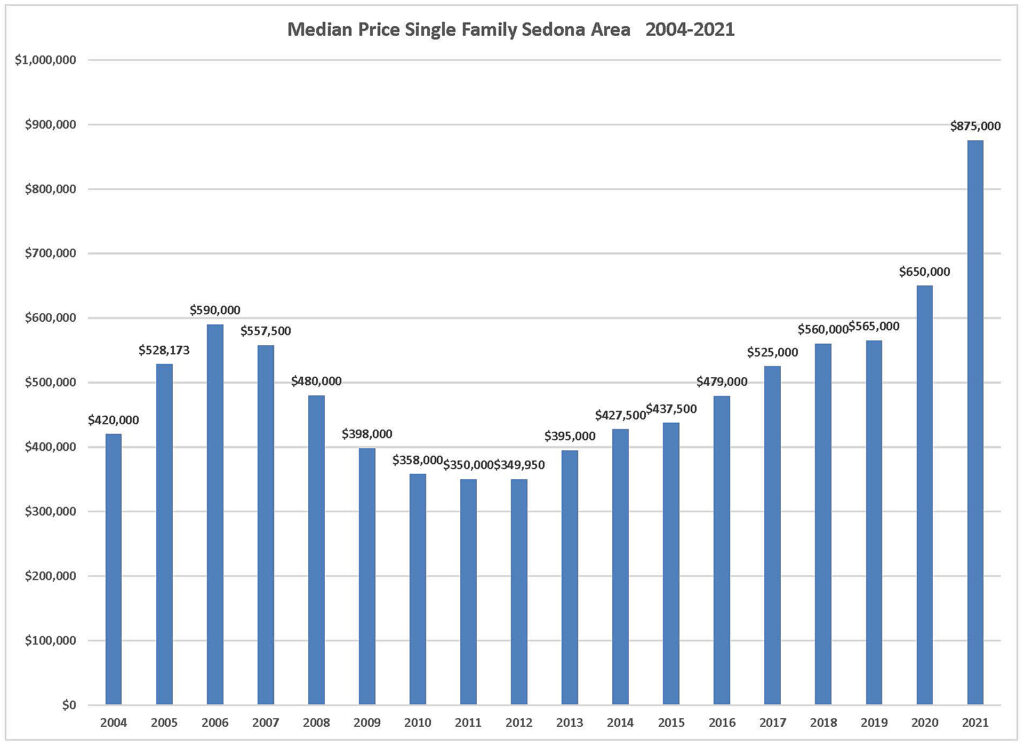

I will start out with the median sales price. For the Sedona area the median sales price rose to $875,000 up 35% year over year from 2020. That was a $225,000 increase in the median sales price in one single year. The median sales price increases for the other areas of the Verde Valley were just as striking. Cottonwood came in at $396,000 a 22% increase, Rimrock came in at $331,500 a 41% increase and Camp Verde came in at $418,500 a 40% increase. To say that we have never seen median sales prices this high anywhere in the Verde Valley is an understatement.

The 2021 real estate market in the Verde Valley provided us a number of other exceptional results

- The cumulative days on market plummeted to 51 days, down 40% from 2020

- In the Sedona market there were 224 sales over $1,000,000, up 88% from 2020 and up 400% from 2019

- In the Sedona market vacant land sales came in at 322 sales, up 63% from 2021

- Sedona area Townhomes and Condominium median sales price jumped to $498,000, up 28% from 2020

- January residential inventory in the Sedona market dropped to 102 units for sale down 50% from January 2020.

There are a couple of major factors that are driving our current market. Increased numbers of sales and an acute lack of inventory. Let’s look at inventory first. The overall consensus is that nationwide we are looking at a 3,000,000 to 5,000,000 shortfall in housing units for our population. We have been seeing our inventory in the Verde Valley shrink for the last ten years. Since 2008 home builders have not been building enough homes to keep up with household formation. The depth of the construction shortfall means we are still, at minimum, years away from a balanced housing market, much less one with abundant housing. Baby boomers are staying in their homes longer and rising prices enable folks to tap their equities for emergencies, all resulting in a decline in inventory.

On the sales side we are seeing an increase in the total number of sales. The demand from buyers for short term rentals has accelerated. According to the City of Sedona there are about 825 short term rentals in Sedona, 13% of the homes, and another 500 or so in the Village of Oak Creek. Buyers looking for and buying homes to be used as short-term rentals have had an impact on pricing in this market due to the very significant amount of rental income being projected and realized with short term rentals. With the onset of Covid we are seeing buyers coming into our market that are able to work from home. Combine all this with California buyers coming into our market with excess cash in their hand and classic supply and demand comes into play, followed by the dramatic rise in prices we are experiencing.

So, what about 2022?

Mortgage rates will likely go a little higher.

The Federal Reserve is expected to raise interest rates a few times in 2022, which means mortgage rates will likely rise. Both Redfin and Realtor.com predict a 30-year-fixed mortgage rate will reach 3.60% by the end of 2022, compared to an average of 3.30% now. There are some forecasts predicting that interest rates will reach into the 4% range which could have some impact on pricing by the end of 2022. That’s not necessarily bad news for buyers, with a dampening effect on price increases.

Prices will keep on rising. Inventory will be tight.

All the indicators say that inventory will continue to stay in short supply. We generally see an uptick in inventory in the spring and summer but with the extreme shortfall that we currently have it is unlikely that we will have enough inventory to meet the demand. As of this writing there is about a 22-day supply of residential inventory for sale in the Verde Valley. A six-month supply is normal for a market in balance. I expect there to be demand coming from California and the upper Midwest like we have seen before but maybe even stronger this year. At this point homes are selling within a few days of when they come on the market and I do not see that changing any time soon with inventory as tight as it is and demand as strong.

I have said this before but I feel it needs to be said again. A real downside for the ever-increasing residential values in Sedona and the Verde Valley is that folks who are working in our service industry and are wanting to afford a home cannot. Even with low interest rates the median income family cannot afford the median sale priced home anywhere in the Verde Valley. In addition to increased sales prices, many rental homes have migrated to short term rentals or the rent has been increased making rental homes unaffordable too. Where are folks who work in the Verde Valley going to live? This will turn critical for Verde Valley employers.

Just the Facts:

Sedona Area: The median price of a single-family home rose to $875,000 the highest median sales price ever. This was a 35% increase over 2020, a $225,000 increase in one year. The number of sales remained flat coming in at 621 sales down 1.5% from 2020 but still a significant increase from the number of sales that we have seen over the last several years. This near record number of sales provided more than enough fuel for the $225,000 increase in price. Inventory of single-family homes for sale at the time of this writing was 31 homes with a median asking price of $1,650,000.

Vacant land transactions for 2021 came in at 322, a 63% increase over 2020. This was the highest number of vacant land sales since 2005. Driven by the increased number of sales, the median sales price for vacant land rose 25.5% to $250,000, its highest number since 2008. The increase in the number of sales has also resulted in a 25% decrease in the number of lots for sale to 155, its lowest number in many years.

It is safe to say that the luxury market, home sales over $1,000,000, was the driving force in the 2021 market. Single family sales over $1,000,000 accounted for 36% of the sales in 2021 coming in at 224 sales, an 88% increase over 2020 and a 400% increase over 2019. As of this writing there are 31 active single-family homes for sale and of those, 21 are priced over $1,000,000. Median asking price for the active listings is $1,650,000.

Cumulative days on the market came in at 51 days, a 40% drop in the days on market from 84 in 2020. With the limited number of homes for sale, and the current demand, I expect the days on market to stay in this range for the foreseeable future.

Not unexpectedly with the dramatic increase in the price for single family home, we saw a dramatic increase in the median sales price for condos and townhomes to $498,000 up 28% over 2020’s $389,174. The number of transactions for the last 12-month period is 138, up 17% from 2020

The median price for mobile homes came in at $399,000 up a solid 22% over 2020. Sales were up 16% to 37 sales from 32 in 2020.

Camp Verde: The median sales price for single family homes in the Camp Verde area for 2021 was $418,500 up 40% from 2020. Its highest yearly total ever. The number of sales was up 38% to 144 sales the highest total sales for this area ever.

Lake Montezuma and Rimrock: The median sales price for single family homes in the Rimrock and Lake Montezuma area for 2021 was $331,500 up 41% from 2020. This is an all-time high for this area. The number of sales came in at 96 sales up 26% from 76 sales in 2020

Cottonwood and Cornville: The median sales price for single family homes in the Cottonwood and Cornville area for 2020 was $396,000 up 22% over 2020. This is the highest median sales price in this area ever. The number of sales in 2021 came in at 603 sales essentially the same as the 601 sales in 2020.

The Bottom Line: All metrics indicate that the market will remain very strong for 2022. Inventory is almost nonexistent with a total of 78 homes not under contract in the Verde Valley as of this writing. That represents a 19-day supply of single-family homes for sale based on the 2021 sales. Interest rates will rise to the 3.5% to 4% range which is still near historic lows. Sellers will remain in control of the market and buyers will need to be decisive and aggressive in their decision making.

For the full Sedona and Verde Valley Real Estate 2021 in Review

Recent Comments