Sedona and Verde Valley Real Estate

Second Quarter 2021

I hear it every day when I talk to Realtors or buyers or sellers, we don’t have any inventory of homes and residential properties for sale. And it is true, at any given point over the last 12 to 18 months there are just not very many homes, or condos, or manufactured homes for sale. For the most part our buyers come to town and they have a very limited number of properties to choose from at any given time.

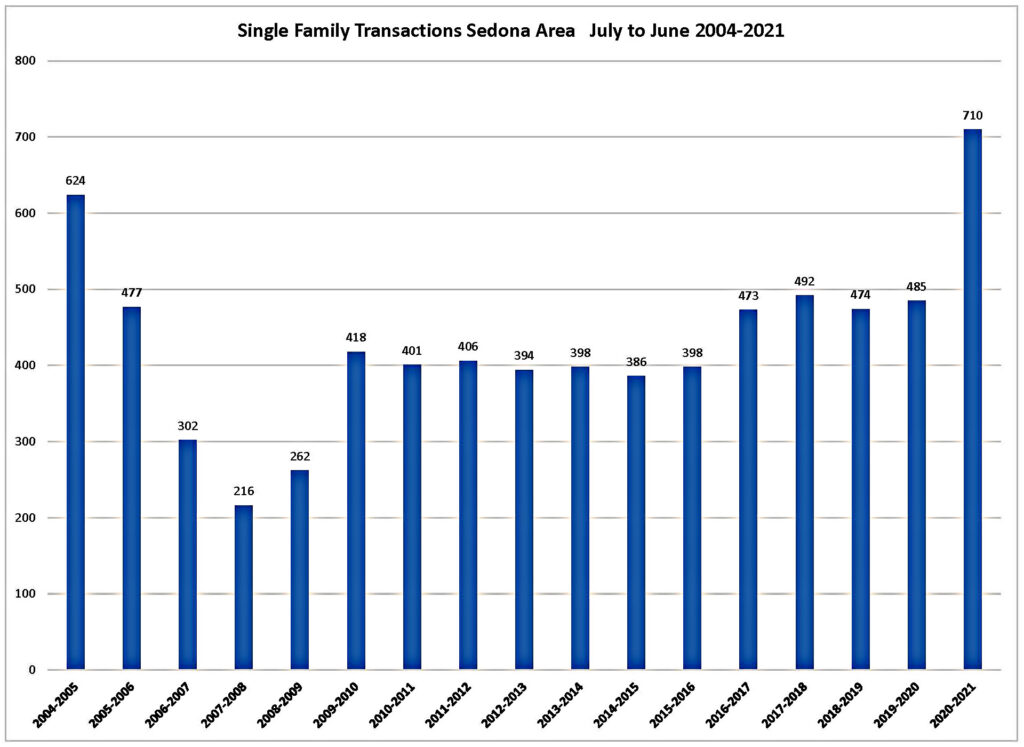

As far as real estate markets go, Sedona and the Verde Valley is a small market with around 2,000 single family sales per year, with Sedona having had around 475 single family sales per year over the last 4 years or so. But when I look at the graph below and see that there were 710 sales in the last 12-month period up 47% from the previous 12-month period, we had 225 more sales in that time so we must have had 225 more homes to sell.

So, wait a minute, we had plenty of homes for sale for our “normal” market, we might have even seen an increase in inventory, but instead we had an influx of almost 50% more buyers into our market. Boom, acute shortage of inventory and a 30% spike in year over year median sales price to $751,250. Even more unconceivable, the median sales price for the first half of 2021 spiked to $850,000 up 46% when compared to the first half of 2020.

Sedona was not the only area in the Verde Valley that saw an increase in first half 2021 transactions and median sales price.

- Cottonwood-Cornville: 7% increase in sales to 622, median sales price rose 22% to $377,750.

- Camp Verde: 60% increase in sales to 69, median sales price rose 24% to $385,000.

- Rimrock-Lake Montezuma: 75% increase in sales to 49, median sales price rose 36% to 315,000.

We all know instinctively that this kind of increase in prices is not sustainable. So, it’s unsurprising, then, that the questions “are we in a housing bubble?” and “will the housing market crash, are on everyone’s mind. Housing prices are a scary place to have the kind of price volatility that we are seeing in today’s market.

We did not just wake up and find ourselves in this market. We have had low interest rates and good demographics, households being created and millennials aging into their prime home buying years, for several years now combined with the fact that builders have been building homes down 35% from the pace in the mid 2000’s. Estimates vary but the consensus is that we are about 4 million homes short for our current population.

It is very challenging to say for a fact we are in a bubble and what the outcome will be. When we look at the real estate market compared to 2006-08 there are a lot of differences, most of them positive:

- Interest rates are low and are now looking to rise just slightly over the next year.

- It is still harder to get a loan, buyers credit scores are higher, they are putting more down and adjustable-rate mortgages are few.

- We are short about 4 million homes nationwide compared to being overbuilt by several million in 2006-08

- Overall, the consumer is in a lot better shape, their debt as a percentage of income is down and with rising prices for the last 10 years, they have accumulated about 21 trillion in home equity

- Millennials are now the biggest demographic in this country and they are buying homes in record numbers.

- Inventory of homes for sale nationwide are at historic lows.

Are we in a bubble? I come back to the fact that the rising prices that we are seeing in the Verde Valley are not sustainable and that at some point they will slow and given the sharp increases we have seen may even come down some. But overall, as a country, it does not appear that if we have a slowdown, it will be as dramatic as the great recession. The factors above will help insure that we will not see the dramatic drops that we saw in 2008-2012. However, markets are local and the price increases we are seeing are considerably larger in Sedona and the Verde Valley than other parts of the country and if and when we see a slowdown, it may have a little more of an impact in our markets.

Just the Facts:

Sedona area:

The median price of a single-family home continues to set records coming in at $751,250. This was a 30% increase over the last 12-month period’s $599,000. The last 12-month period saw 710 sales a 47% increase over the previous 12-month period’s 485 sales. This was the largest number of sales in a 12-month period ever. In the face of very strong demand, residential inventory continued to drop another 6% over the last 90-day period.

The number of vacant land sales skyrocketed with 220 sales in the first six month of 2021 and making up a total 365 sales over the last 12-month period. That equated to a 266% increase in land sales over the last 12 months compared to the previous 12 months and the highest total number of land sales in the last 16 years. With land sales at this blistering pace came a reduction in the number of lots for sale to 155 lots.

Off the chart is the only way to describe the sales in the Sedona area in the over $1,000,000 market. In the last 12-month period there were 196 sales over $1,000,000, that is a 360% increase compared to the previous year’s 54 sales. There is no year that compares to the last 12 months. You just have to say that there is a Tsunami of buyers in this price range coming from all parts of the country. Affluent Americans with the flexibility to work from anywhere are taking advantage of low mortgage rates and buying up high-end houses—particularly in popular vacation destinations such as Sedona—which is contributing to the surge in luxury-home sales.

Cumulative days on the market came in at 60 days, 35% lower than the previous 12-month period, many homes are selling before they ever reach the market. I expect this trend to continue for the rest of 2021. This will be a key indicator to keep your eye on as we move forward through this extraordinary market

Not unexpectedly with the dramatic increase in the price for single family homes we saw an increase in the median sales price for condos and townhomes to $420,000 for the last 12 months 9% over 2020’s $389,174. The number of transactions for the last 12-month period is 154, up 30% from 2020.

Camp Verde:

The median sales price for single family homes in the Camp Verde area for the last 12-month period rose to $350,000, 22% higher than the previous 12-month period. The number of sales was up 37% to 131 sales for the last 12 months. The median sales price for the first 6 months of 2021 came in at a $350,000 up 24% from the first six months of 2020.

Lake Montezuma and Rimrock:

The median sales price for single family homes in the Rimrock and Lake Montezuma area for the last 12 months came in at $279,000 up 21% from the previous 12-month period. The median sales price for the first six months of the year followed the shocking numbers in the other Verde Valley markets coming in at $315,000 up 36% from the first half of 2020. The number of transactions in the first half of the year jumped up 75% to 49 sales compared to 28 for the first half of 2020

Cottonwood and Cornville:

The median sales price for single family homes in the Cottonwood and Cornville area for the last 12 months came in at $352,000 up 17% from the previous 12-month period’s $299,700. The number of sales was up 15% to 622 sales for the last 12-months. The median sales price for the first half of 2021 came in at $377,750 up 22% from the first half of 2020.

The Bottom Line:

We have seen a dramatic increase in the number of buyers coming into the Verde Valley and combined with a short supply of homes, prices are being pushed up spectacularly. All the factors are in place for this to continue for the rest of 2021 and into 2022. It is a great time to be a seller, especially if it is a home, you are not living in. For buyers, they need to be bold when making an offer, there is a lot of competition out there.

Click here for the Full Sedona and Verde Valley Market Report

Recent Comments