Verde Valley Real Estate Third Quarter 2021

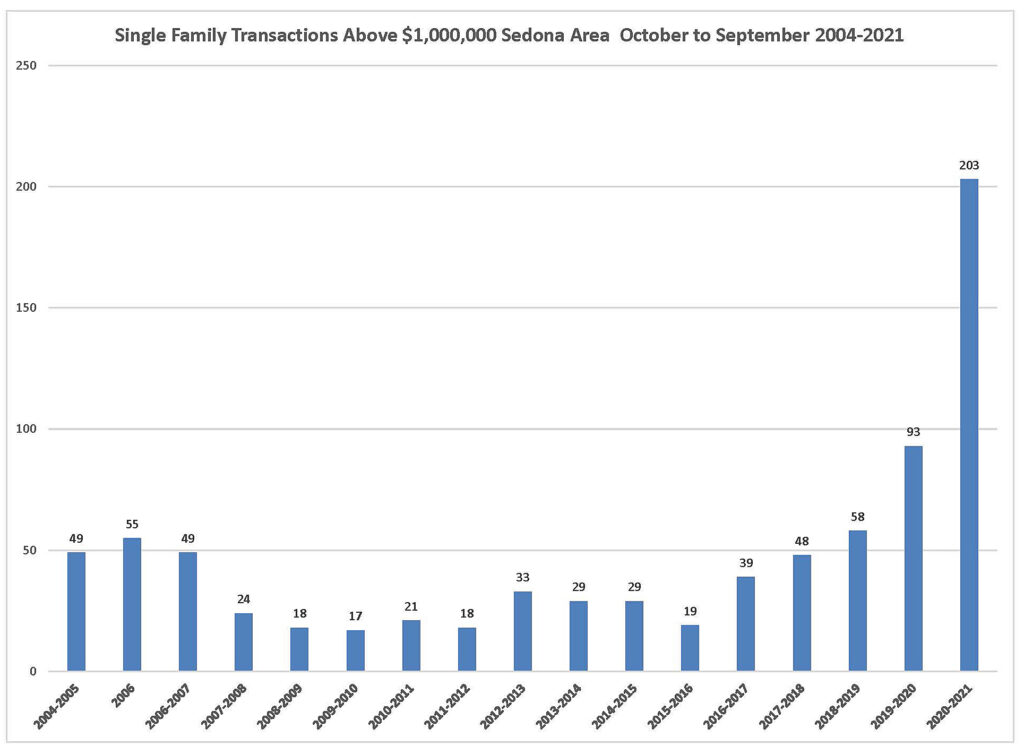

The real estate market that we have been in for the last 18 months continues to surprise me. Every quarter brings another surprise, another astounding number, among other astonishing numbers. The surprise for this quarter and the last 12 months is in the number of sales above $1,000,000. We have seen for the last five years an increase in the sales over $1,000,000 from 19 sales in 2015-2016 to 58 in 2018-2019, 93 sales in 2019-2020 to a whopping 203 sales in 2020-2021.

This number is so far above the previous numbers it begs the question- WHY! That answer lies in an overall look at what is going on in not only our local market in Sedona and the Verde Valley but what is going on in the market nationwide.

So, let’s take a look at a number of key statistics. Home prices are at a record high, check. Inventory is at record lows, check. Average days on market at record lows, check, Percentage of homes selling above asking price at record highs, check!

So…. what is causing all of this. The short answer is supply and demand, the longer answer, supply and demand.

On the demand side, demographics is the big force driving this market. Millennials are the largest generation in history. I know, they do not have that much of a direct impact on our market, but Boy Howdy, they do in our feeder markets, especially in California. Millennials have been constrained in coming into the market over the last decade. Many saw their parents suffer through losing a home in the great recession, did not have enough income early in their careers and now after having been cooped up in the pandemic, they are ready to buy a home and have been storming the market. Add to that historically low interest has lured them in to the market and has encouraged and allowed higher bids and prices.

On the demand side add into the equation one of the outcomes of the pandemic, employers and more importantly employees have figured out that they can work remotely almost anywhere. So do you want to commute 50 miles each way to work or do you want to live in a less populated area of the country with clean air and water. Voila! Not a hard choice for them to make.

Here is a look at single family sales in the for the Verde Valley for the last 12 months:

- Sedona sales 653, up 17%

- Camp Verde sales 135, up 42%

- Rimrock/Lake Montezuma 94 sales up 25%

- Cottonwood/Cornville 621 sales up 12%.

Overall, single-family sales in the last 12 month were up 17% compared to the previous 12-month period.

Supply side issues are an equally important part of the equation. We should have seen this coming for many years. By many estimates as a country we are 5 million homes short nationwide. Builders have never ramped up the necessary production to account for the million or so households that are created each year. And as I have said before seniors are now more likely to “age in place” which is keeping millions of homes off the market.

Another factor which starts off as a demand side factor and rotates into a supply side factor is the proliferation of short-term rentals both nationwide and acutely in Sedona. In the four years that short term rentals have been allowed in Sedona, according to City of Sedona statistics, there are as of about a month ago 815 single family homes in Sedona being advertised as short-term rentals. With fabulous claims of high rental income this has had an impact on what some buyers are willing to pay for homes. From the supply side, the proliferation of short-term rentals has significantly reduced the number of homes in the Sedona market used for long term rentals.

With the increased demand and short supply of inventory just how has it impacted the median sales price in the Verde Valley for a single-family home for the first nine months 2021:

- Sedona area $852,500, up 37%

- Camp Verde Area $393,500, up 32%

- Rimrock/Lake Montezuma area $319,900, up 37%

- Cottonwood/Cornville area $390,000, up 24%

Just the Facts: I prepare these statistics four times a year on a quarterly basis, looking back a year at a time. These statistics are for the time period October 1, 2020 to September 30 2021. When I state that a figure is up or down it is in reference to the previous 12-month period October 1, 2019 to September 30 2020.

Sedona area: The median price of a single-family home continues to set records coming in at $827,000 for the last 12-month period, this was a 36% increase over the previous 12-month period’s $610,000. The last 12-month period saw 653 sales, up 17% from 556 sales. This was the largest number of sales in a 12-month period ever in the Sedona market. Residential inventory appears to be up slightly but a closer look reveals that about 60% of those listings are under contract. Inventory remains very tight.

Vacant land transactions have taken off, exploding from being constrained from 15 years of a lack luster market. In the last 12-month period there were 371 sales of vacant lots in the Sedona area up 233 % from 159 sales. The median sales rose a solid 32% to $245,000. It is interesting to note that in spite of near record sales the median sales price is still no where near the $515,000 prices from the 2005-2006 year.

The $1,000,000 market used to be considered the rarified air of the Sedona market. With 203 sales over $1,000,000 in the last 12 months that segment of the market now claims a 31% share of the Sedona market. A large part of the increase has to do with the overall increase in the median sales price in the Sedona area, which over the last 12 months increased 36% to $827,000. In the last quarter we are seeing about a 15% increase in the number of homes listed above $1,000,000, which might indicate a little slow down in this segment of the market to come.

Cumulative days on the market came in at 54 days, 40% lower than the previous 12-month period, many homes are selling before they ever reach the market. I expect this trend to continue for the rest of 2021. When you consider the number of days that it takes a transaction to close, usually 30 to 45 days, this is an extraordinarily low time on market.

Not to be outdone by the single-family market, prices for condominiums and townhomes are continuing to climb to record prices. The medians sales for condos and townhomes rose to $449,900 up 16% over 2020’s $389,174. The number of transactions for the last 12-month period was 146, up 24% from 2020.

Camp Verde: The median sales price for single family homes in the Camp Verde area for the last 12-month period rose to $375,000, 27% higher than the previous 12-month period. The number of sales was up 42% to 135 sales for the last 12 months. The median sales price for the first nine months of 2021 came in at $393,500 up 24% from the first nine months of 2020. The number of sales for the first nine months was up 40% to 104 sales up from 74 sales for the first nine months of 2020

Lake Montezuma and Rimrock: The median sales price for single family homes in the Rimrock and Lake Montezuma area for the last 12 months came in at $297,500 up 27%. The number of sales for the last 12-month period was up 25% to 94 sales from 75 sales. The median sales price for the first nine months of the year came in at $310,900 up 37% from the first nine months of 2020. The number of transactions for the first nine months of 2021 came in at 73 sales up 35% from the first nine months of 2020

Cottonwood and Cornville: The median sales price for single family homes in the Cottonwood and Cornville area for the last 12 months came in at $375,000 up 22% from $307,000. The number of sales was up 12% to 621 sales for the last 12-months. The median sales price for the first nine months of 2021 came in at $390,000 up 24% from the first nine months of 2020.

The Bottom Line: Home prices are again at a record high. Inventory is at record lows. Average days on market at record lows, Percentage of homes selling above asking price. There is nothing on the horizon to say, other than seasonal changes in the market, that we are looking at more of the same market going into the Winter and Spring of 2022. With that said, looming inflation with the potential for increased interest rates might be the only thing that can put a little water on this on fire real estate market.

Click here for the complete Sedona and Verde Valley Third Quarter 2021 Market update.

Recent Comments