Sedona vacant land sales remain very soft compared to the heyday of 2004 and 2005, but are on track to increase about 20% in the number of transactions in 2012 over 2011. Inventory is down about 11% since the first of the year, but just about the same as it was a year ago. The drop in inventory mainly stems from sellers either giving up or not wanting to sell at today’s reduced prices. Of the 348 vacant land listings currently on the market only 21 (6%) is distressed inventory. As of this writing 13 of the 348 lots are under contract (3.7%). Of the vacant land listings that are distressed inventory, just 2 are under contract. Based on these sales numbers there is an over three year supply of vacant land listings making the land segment of the market a buyer’s paradise.

The number of vacant land transactions has remained steady since the big drops in 2007 and 2008. If the current trend for 2012 continues we should see about a 20% increase in the number of vacant land sales for 2012. Distressed sales accounted for about 45% of the vacant land sales in 2009 and 2010. Distressed sales accounted for 24% of the vacant land sales in 2011. Based on the year to date sales distressed sales will account for about 35% of the vacant land sales in 2012. Distressed sales are continuing to have an impact on values in the vacant land segment of the market.

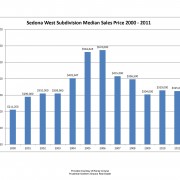

A pleasant surprise is found in the uptick in the median sales price of vacant land in the Sedona area. So far year to date 2012 we are seeing a 20% increase in the median sales price. If this continues it will be the first increase in median sales price since 2006. I am not going to be holding my breath on this. We have a long way to go in 2012

Bottom Line: With the amount of inventory on the market and the sluggish sales numbers it is still a buyer’s market in Sedona for vacant land. With inventories of homes in the $300,000 to $500,000 in short supply we could be looking at price stabilization finally in 2012 for the vacant land segment of the Sedona real estate market

Recent Comments