Verde Valley Real Estate First Quarter 2021

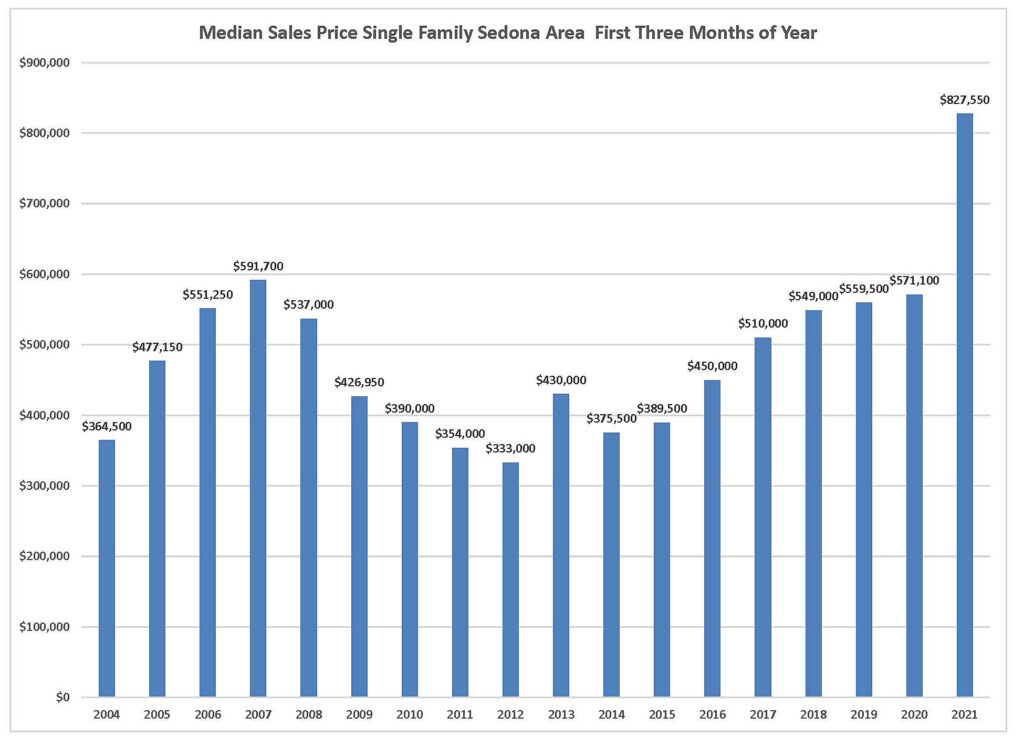

We, by that I mean the entire country, just not Sedona and the Verde Valley, are in a real estate market that is unmatched by anything I have seen or experienced in my 46 plus years in the real estate business. The severe lack of inventory is causing an extraordinary amount of upward pressure on sales prices. In the Sedona area for the first quarter of 2021, somewhat surprisingly, there was the same number of sales as in the first quarter of 2020, but that is where the similarity ends. The median sales price for single family homes in the Sedona area for the first quarter of 2021 came in at $827,550, up 44% from the first quarter of 2020.

To illustrate the gravity of the inventory crisis that we are in, as of this writing in the Sedona area there are 45 active, not under contract, listings for sale. Of those 17 were below $1,000,000 and the median asking price for the 45 listings is $1,580,000. Based on the 631 sales for the last 12 months in Sedona, that is about a 25-day supply of homes available for sale. To break it down to homes sold below a $1,000,000, there were 483 single family homes sold below $1,000,000 in the last 12 months, so those 17 listings are a 12.75-day supply of homes below $1,000,000. And we wonder why there are multiple offers on every home that comes on the market, or is sold before it ever reaches the market.

This inventory emergency is not only in the Sedona area it is throughout the Verde Valley. In the three other areas of the Verde Valley in the last 12 months there were 798 sales of single-family homes. There are 42 active, not under contract listings, an anemic 19-day supply of homes for sale.

So, what can we expect for the rest of 2021?

The U.S. housing market is short about 3 million available homes, according to the National Association of Realtors. It could take a number of years for new construction and existing home sales to catch up, so the low supply is going to be a prevailing trend for some time.

Baby Boomers have been staying put since the start of the pandemic and as more and more of them become vaccinated by the Fall we may see some of them move forward with their relocation plans, this could ease the inventory squeeze slightly.

After bottoming out early this year, mortgage rates have been on an upward trajectory for the last few months — a trend that is likely to remain in place. Although rates are climbing, they’re still extremely low by historical standards, so the higher rates aren’t expected to have a huge impact on mortgage affordability for now.

Just the Facts:

Sedona area: The median price of a single-family home rose to $690,000 the highest median sales price ever. This was a 21% increase over the last 12-month period’s $569,000 a $121,000 increase year over year. The last 12-month period saw 631 sales a 18% increase over the previous 12-month period’s 533 sales. This was the largest number of sales in a 12-month period ever. The Sedona area has experienced a 45% decrease in residential inventory over the last 18 months.

Vacant land transactions are back! In the last 12-month period there were 257 vacant land sales up 71% from the previous 12 month’s 150 sales. Driven by the increased number of sales the median sales price for vacant land for the last 12-month period came in at $215,000, a 26% increase over the previous 12-months period’s $170,000. The increase in the number of sales has also resulted in a 53% decrease in the number of lots for sale to 157, over the last 18 months. Its lowest number in many years.

I know you are not supposed to yell “FIRE” in a crowded room, but that is the only way to describe the over $1,000,000 market in Sedona. In the last 12-month period there were 151 sales over $1,000,000 that is 279% higher than any previous 12-month period in our market history. If you have a home over $1,000,000 and you have been thinking of selling, think no longer, act!

Cumulative days on the market came in at 69 days, 22% lower than the previous 12-month period, to nobody’s surprise. With homes selling before they even enter the market, I expect this trend to continue for the rest of 2021.

Not unexpectedly with the dramatic increase in the price for single family homes we saw an increase in the median sales price for condos and townhomes to $410,000 for the last 12 months 5% over 2020’s $389,174. The number of transactions for the last 12-month period is 131, up 11% from 2020.

Camp Verde:

The median sales price for single family homes in the Camp Verde area for the last 12-month period rose to $320,000, 15% higher than the previous 12-month period. The number of sales was up 11% to 111 sales for the last 12 months. The median sales price for the first 3 months of 2021 came in at a staggering $400,000 up 21% from the first 3 months of 2020.

Lake Montezuma and Rimrock:

The median sales price for single family homes in the Rimrock and Lake Montezuma area for the last 12 months came in at $245,000 up 5% from the previous 12-month period. The median sales price for the first 3 months of the year followed the shocking numbers in the other Verde Valley markets coming in at $295,000 up 17% from the first quarter of 2020.

Cottonwood and Cornville:

The median sales price for single family homes in the Cottonwood and Cornville area for the last 12 months came in at $338,500 up 16% from the previous 12-month period’s $290,500. The number of sales was up 7% to 604 sales for the last 12-months. The median sales price for the first quarter of 2021 came in at $353,767 up 21% from the first quarter of 2020.

The Bottom Line: We will have a market with low interest rates, and good availability of credit but severely impacted by the number of homes available for sale. Buyers need to be prepped for multiple offers and having their credit “house” in order. This will continue on into the foreseeable future. An absolutely fantastic time to be a seller and a buyer’s market that is not for the faint at heart.

For the full Verde Valley Real Estate First Quarter 2021 report

Recent Comments