Verde Valley Real Estate First Quarter 2022

So, as we end the first quarter of 2022, what is the state of the housing market in Sedona and the Verde Valley and where is it headed for the rest of 2022?

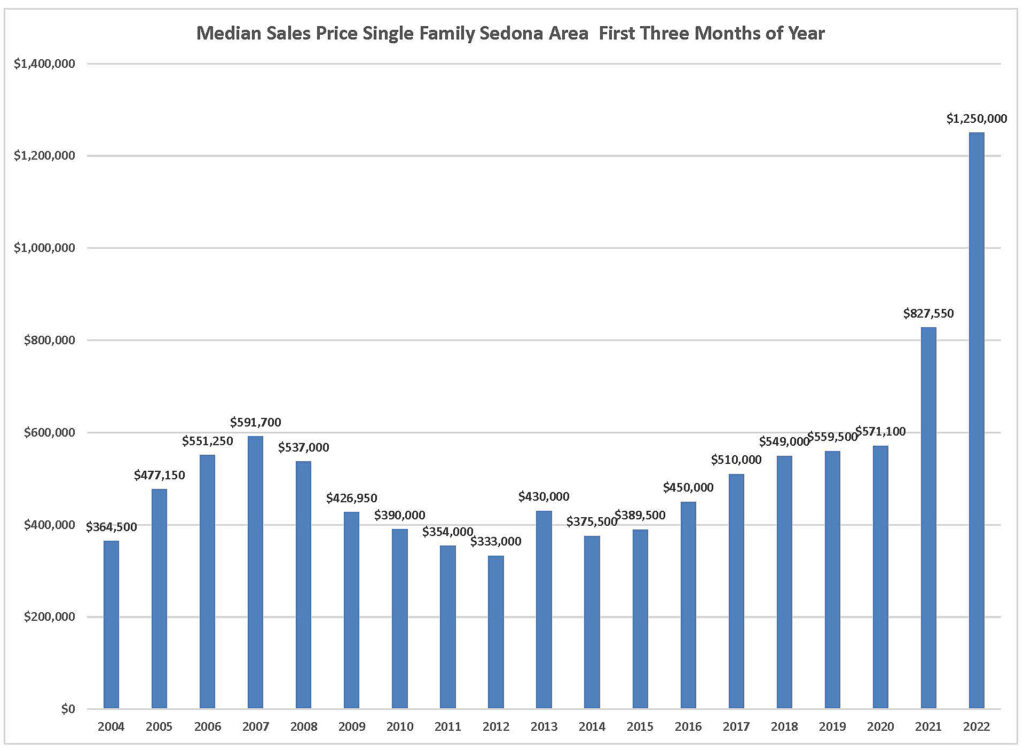

Today as I write this report there are currently 26 single family homes active on the market, not under contract, in the Sedona area. Of those 4 are priced under $1,000,000 and the median asking price is $1,537,000. One year ago, there were 45 active, not under contract listings, a 58% reduction from the number of homes available at this same time 1 year ago. The result? We have seen the median sales price for the last 12-month period for a single-family home rise to $916,000 and for the first quarter of 2022 rise to an unmatched $1,250,000.

Based on the 621 sales for the last 12 months in the Sedona area, that is about a 15-day supply of homes available for sale. Four to six months is considered a market in balance. For homes priced under a million dollars based on the last 12-month sales there is a 4-day sale of homes under a $1,000,000 for sale in the Sedona market.

Day after day we see inventory come on the market below $1,000,000, only to go under contract a few days later. It is no wonder that we have seen the cumulative median days on market plummet to just 48 days, over the last 12-month period.

This inventory emergency is not only in the Sedona area, it is throughout the Verde Valley. In the three other areas of the Verde Valley in the last 12 months there were 865 sales of single-family homes. There are 53 active, not under contract listings, a paltry 22-day supply of homes for sale.

So, what can we expect for the rest of 2022?

Inventory will continue to remain tight and buyer demand strong. We are still seeing that we have more buyers than we have inventory. When demand is satisfied, prices fall. At this point in Sedona and the Verde Valley there is an extreme demand for homes, and there simply aren’t enough homes to sell to our prospective buyers. Home construction has been increasing in recent years, but it is too far behind to catch up. To see significant declines in home prices, we would need to see significant declines in buyer demand and with the nationwide housing shortage estimated at 3,000,000 homes, it will not be in 2022

Interest rates are on the rise. We have been in a multi-year period of historically low interest rates. Over the last several weeks we have seen the rate for a 30-year loan with good credit climb into the 5% range. Although this is higher than it has been in several years it is still historically low. With the Federal Reserve expected to continue to raise their rate, it looks like rates could remain close to 5% for the rest of the year. There is no doubt that the rise in interest rates will have a dampening effect on our market, but with the strong demand and inventory shortfall, I do not anticipate a halt to home price appreciation. A slower rate of appreciation is more likely.

Just the Facts:

Sedona area: The median price of a single-family home rose to $916,000 the highest median sales price ever over a 12-month period. This was a 33% increase over the last 12-month period’s $690,000, a $226,000 increase year over year. The last 12-month period saw 621 sales, a slight 1.5 % decrease year over year. The first quarter of 2022 saw an 18% decrease in the number of sales compared to the first quarter of 2021. Even though the number of sales, year over year remained steady I believe that the severe shortage of listings combined with the extraordinary increase in pricing is having an impact on the numbers of transactions. Even with the decline in the first quarter sales, the median sales price for single family homes in the first quarter of 2022 came in at a dumbfounding $1,250,000

Vacant land transactions continued on their upward trajectory over the last two years. In the last 12-month period there were 293 vacant land sales up 14% from the previous 12 month’s 257 sales. Driven by the increased number of sales the median sales price for vacant land for the last 12-month period came in at $275,000, a 28% increase over the previous 12-months period’s $215,000. Even with the uptick in the number of sales we have seen a 17% increase in the number of lot listings with some sellers wanting to take advantage of the increasing prices.

Of the 621 single family homes sold in the last 12 months, 260 of them, 42% were over $1,000,000. This is an unprecedented number of sales for the over $1,000,000 price point. This trend is not subsiding, for the first quarter of 2022 43% of the sales have been over $1,000,000.

Cumulative days on the market came in at 48 days, 33% lower than the previous 12-month period, to nobody’s surprise, I don’t know how this days on market number can go much lower. With homes selling before they even enter the market, I expect this range to continue for the rest of 2022.

Not unexpectedly with the dramatic increase in the price for single family homes we saw an increase in the median sales price for condos and townhomes to $500,000 for the last 12 months 24% over 2021’s $410,000. The number of transactions for the last 12-month period is 139, up 6% from 2021.

Camp Verde: The median sales price for single family homes in the Camp Verde area for the last 12-month period rose to $430,500, 34% higher than the previous 12-month period. The number of sales was up 30% to 144 sales for the last 12 months. The median sales price for the first 3 months of 2021 came in at an astounding $528,650, up 32% from the first 3 months of 2021. Just a few years ago that was the median price for a home in Sedona.

Lake Montezuma and Rimrock: The median sales price for single family homes in the Rimrock and Lake Montezuma area for the last 12 months came in at $365,000 up 49% from the previous 12-month period. The median sales price for the first 3 months of the year followed the impressive numbers in the other Verde Valley markets coming in at $389,900 up 32% from the first quarter of 2021.

Cottonwood and Cornville: The median sales price for single family homes in the Cottonwood and Cornville area for the last 12 months came in at $407,950 up 21% from the previous 12-month period’s $338,500. The number of sales was up 3% to 624 sales for the last 12-months. The median sales price for the first quarter of 2022 came in at $433,000 up 22% from the first quarter of 2021.

The Bottom Line: We have more buyers than we have listing inventory. Interest rates will be higher for the rest of the year. For the near term, we will need to see a combination of increased listing inventory and weakening buyer demand to cause any significant change on our market. Last year, homeowners saw a market in which their properties sold quickly and frequently above the asking prices, as numerous home buyers fought for the winning bid, this will continue to be the norm through the summer months. Sellers will be rewarded with record prices for the rest of 2022.

For the complete Verde Valley First Quarter statistics click here

Recent Comments