Verde Valley Real Estate

Second Quarter 2022

From the 50,000-foot perspective the real estate market for Sedona and the Verde Valley looks incredible. The median sales price for single family homes in the Sedona area, year over year, shows a median sales price of $975,000 up 30% in the last 12 months and up 68% over the last 2 years. What could be better, this is nothing short of astonishing? But wait, the median sales price in the Sedona area for the first 6 months of the year came in at a gasp-inducing $1,120,000, up 93% from just 2 years ago. I have just one word for this, Unsustainable!

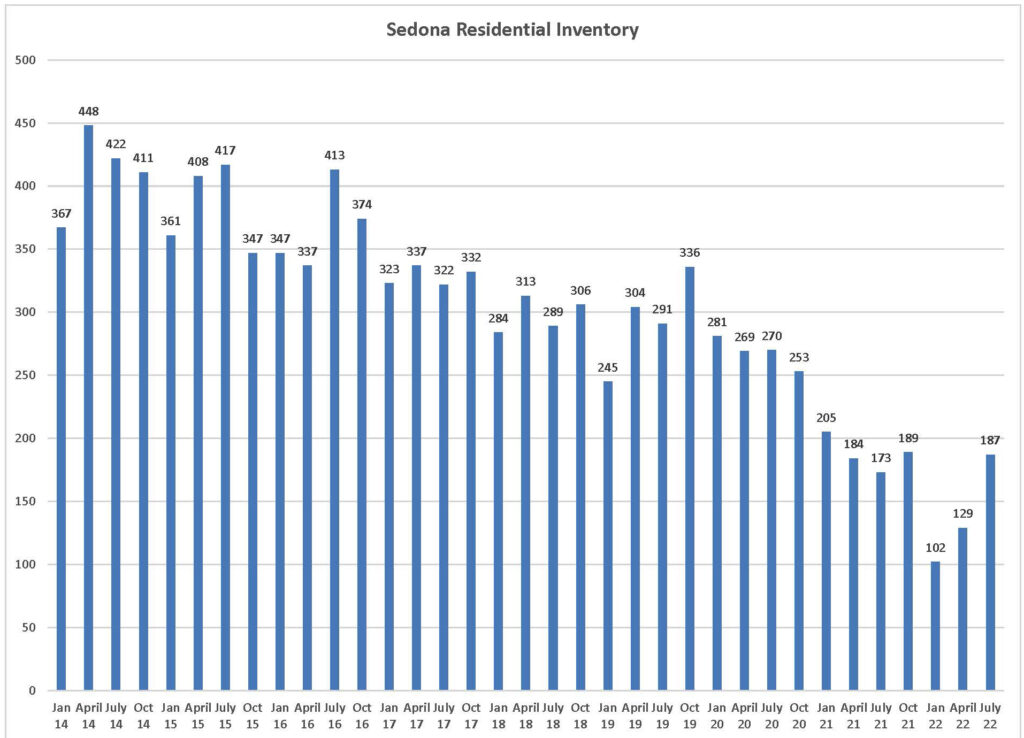

If you are a real estate practitioner in Sedona and the Verde Valley you know something is afoot. Something is different than it was at the beginning of 2022, INVENTORY. After a multi-year decline, inventory is on the rise. The graph below shows active listings and listings under contract. I have used this convention for all of the years in the graph. It shows an 83% increase in residential inventory since the beginning of 2022.

For a more realistic look at the inventory, in particular single-family listings in the Sedona area, in early April 2022 there were 26 single family homes on the market that were not under contract, with only 4 listings with an asking price below $1,000,000. Contrast that with today. There are 93 single family homes on the market in the Sedona area not under contract, with 30 listings below $1,000,000. That is a 358% increase in active single-family inventory in just three months.

One can only speculate that supply and demand will come into play, and I suspect that it already has in the form of a slowing down in the number of sales. The Sedona area is already experiencing a reduction in the number of sales with a 20% reduction in sales year over year, and a 16% reduction in the first 6 months of 2022 compared to 2021. When you delve a little deeper you see that in the second quarter of 2022 there were 129 single family sales down 30% from the 182 single family sales in the second quarter of 2021. I believe this is the direct result of the market forces that will most likely be in effect for the rest of 2022.

So, where do we go for the rest of 2022?

I think we can all pretty much agree that Federal Reserve policy will be the driving force for the economy and the real estate industry for the balance of 2022 and 2023. When the Federal Reserve increased interest rates, mortgage interest rates followed right along in spectacular fashion, almost doubling the 30-year fixed rate to 6% for borrowers with good credit. Rates have backed off a bit into the mid 5% range, but are expected to remain in this range for the balance of 2022. Still low by historic standards. About half of the sales in the Sedona area for 2022 have been for cash but that means that half are borrowing money with significantly higher payments.

If you have been talking to prospective buyers, many have turned cautious. They are all aware of higher inflation, the dramatic increase in home prices (who wants to buy at the top of a market?), the drop in their stock market accounts, the war in Ukraine, higher gas prices, our own political uncertainly with elections coming up, lingering Covid, and the potential that we are at the top of a market and prices will be cheaper just down the road. Ok, there is just a lot of uncertainty out there.

Even though we have seen a dramatic increase in listing inventory we still have inventory levels significantly below pre-pandemic levels. We still have a nationwide housing shortage of several million homes. We are not set up for the kind of dramatic price reductions that we saw in the great recession. However, in a market that has seen prices rise 60% and 70% over the last two years, I think it is fair that say that prices will be leveling and have the potential to drop 5% to 10% between now and the end of 2022. Just saying.

Just the Facts:

Sedona area: The median price of a single-family home came in at $975,000 for the last 12-month period. This was a 30% increase over the previous 12-month period and a 68% increase over the previous 2-year period. The last 12-month period saw 571 sales of single-family homes, a 20% decrease over the previous 12-month period. For the first six months of 2022 compared to 2021 there were 262 single family sales compared to 310 in the first 6 months of 2021, a 16% decrease. The median sales price for single family homes in the Sedona area for the first 6 months of 2022 came in at $1,120,000 up 32% from the first six months of 2021. In spite of the increase in inventory that has occurred in the second quarter of the 2022, as of yet we are not seeing a reduction in the median sales price.

Residential inventory is finally on the rise, with a 45% increase in the last quarter to 187 residential units and an 83% increase when compared to 102 units on the market in early January 2022. This will be the real story as we progress through the remainder of 2022.

Vacant land transactions slowed down over the last 12-month period with 218 sales compared to 336 sales in the previous 12 months, down 36%. Even with the downturn in the number of sales, the median sales price for vacant land came in at $299,000, up 31% from the previous 12 months. This is the highest median sales price for vacant land in the last 14 years. Vacant land inventory in the Sedona area is down 25% from what it was in July of 2021.

Of the 571 single family homes sold in the last 12 months, 270 of them, 47%, were over $1,000,000. This was a 38% increase in the sales over $1,000,000 compared to the 196 sales in 2021, and a 500% increase from just 2 years ago.

Cumulative days on the market came in at 47 days, 22% lower than the previous 12-month period. With the increase in the amount of inventory over the last three months this will be another bell weather indicator to keep an eye on for the rest of 2022.

The Condominium and Townhome market continued to remain strong with the median sales price coming in at $537,500 up 31% from the previous 12 months $410,000. Sales remained steady at 128 sales compared to 131 for the previous 12 months.

Camp Verde: The median sales price for single family homes in the Camp Verde area for the last 12-month period rose to $455,000, 30% higher than the previous 12-month period. The number of sales remained steady at 129 sales just a 1% drop from the previous 12 months. The median price for a single-family home in the Camp Verde area for the first 6 months of 2022 rose to $485,000 up 26% form the previous 12 months. The number of sales for the first 6 months dropped 23% to 53 sales compared to 2021. It is interesting to see prices remain high in spite of the drop in sales and how long this trend can continue.

Lake Montezuma and Rimrock: The median sales price for single family homes in the Rimrock and Lake Montezuma area for the last 12 months came in at $370,000 up 33% from the previous 12-month period. The number of sales for the last 12 months came in at 91 sales down just 6% from the previous 12-month period. The median sales price for the first 6 months of the year came in even higher at $392,450 up 25% from the first 6 months of 2021.

Cottonwood and Cornville: The median sales price for single family homes in the Cottonwood and Cornville area for the last 12 months came in at $430,000 up 22% from the previous 12-month period’s $352,000. The number of sales was virtually unchanged coming in at 628 sales compared to 622 for the previous 12-month period. The median sales price for the first 6 months of 2022 came in at $440,000 up 16% from the first quarter of 2021.

The Bottom Line: External market and geo-political forces are in play. Inflation will be with us for the rest of 2022. The Federal Reserve will be continuing to raise rates at least into the Fall. 30-year mortgage rates will remain higher than they have been in recent years, impacting borrower’s buying power. We will see inventory continue to grow into the fall along with fewer potential buyers, setting the market up for prices to soften and potentially drop over the coming months. Change is in the wind.

Recent Comments